With all mortgages, initially most of your repayment is interest. In an average Australian mortgage of $625,791, the repayment is $3,863 a month, with interest paid being $3,270 & only $593 going toward the principle in the first month. Compared to your final repayment where $20 is paid in interest & $3,841 goes towards your principle.

Principal: The original loan amount.

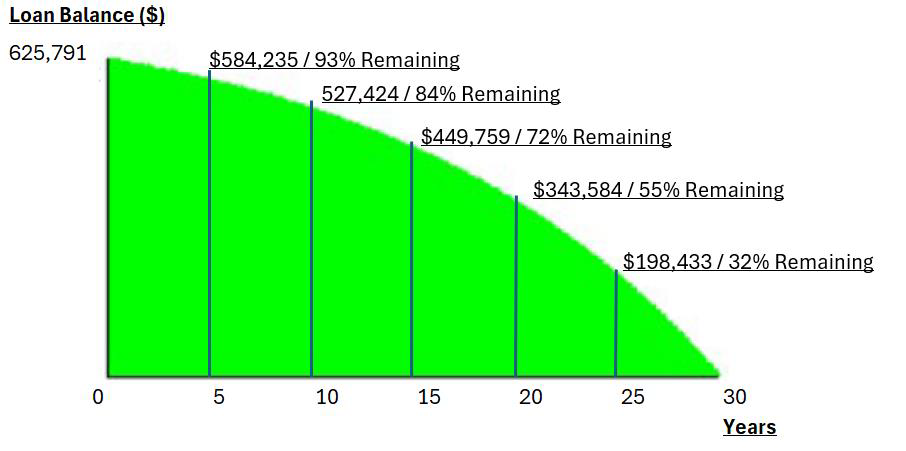

This has to do with how interest is charged, which as graphed below shows your principal is repaid exponentially, not linearly.

In the early years you’re mostly paying interest with very little going towards principal.

To put into perspective, by the 20th year of your mortgage, you would only have paid down 45% of your mortgage. That means 55% of your mortgage is paid in the final 10 years. In a deeper perspective, 32% of your mortgage is paid in the final 5 years!

Because of the way interest is charged, to maximise interest saved off your mortgage as well to reduce the loan term it is best to attack your mortgage early on. If you were to add $10 in extra repayments to your mortgage from day one, you would save $19,116 in interest & 0.5 year off your loan term compared to is you started adding $10 a month 10 years into your loan term. Though the best time to implement money savings strategies is on day one, you can still save significantly by implementing hacks at any point throughout your home loan journey.

How interest is charged.

Interest is “calculated daily” meaning that if you owe $300,000 at 7%, your daily interest cost is $57.53. Over a 30 day month, it will add up to $1726.03. However interest is “charged monthly in arrears” meaning this interest cost is added to your loan once at the end of the payment month. If your loan settled on the 16th of January, the bank would then add this interest to your loan on the 16th of February & the 16th of every subsequent month. On the 16th of February you owe $301,726.03. Then, when your $2,000 monthly repayment hits your account, you owed $299,726.

You will save the most interest if you attack your mortgage early on.

What determines interest rates

Lenders rate offering are determined based on a number of factors including the Reserve Bank of Australia (RBA) Cash Rate, market conditions & supply & demand. Typically lenders will assess their rates once a month, but must comply with Australian Regulations & Laws with any rate changes.

What gets you a lower interest rate

When negotiating your interest rate with lenders there are a many considerations. In essence, the lenders typically look at your risk levels and how well you fit into their policies and target demographics to determine your interest rate and fee waivers. Most of these are discussed in detail in our book titled ’41 Ways To Pay Your Mortgage Early Without Sacrificing Your Lifestyle Or Investing’ (Reach out to get a free copy). But some of the considerations that you can use to get the best interest rate and fees possible are

- Loan To Value Ratio (LVR)

- Total loan amount

- The security type, location & value

- Your credit score

- Your occupation

- Your family & financial position

- Your future plans

- Lender policies