Restructuring

/Restructuring

Debt restructuring is the process of reorganising your existing debts to make them more manageable. This might involve consolidating multiple debts into one loan, extending loan terms to reduce repayments, or shifting high-interest debts into a lower-interest structure like a home loan. The goal is to align your repayments with your current financial situation and lifestyle — whether that means reducing monthly pressure, freeing up cash flow, or simplifying how you manage your money. It’s not about taking on more debt, but rather making your existing commitments work better for where you’re at in life.

Our 1-Page Report

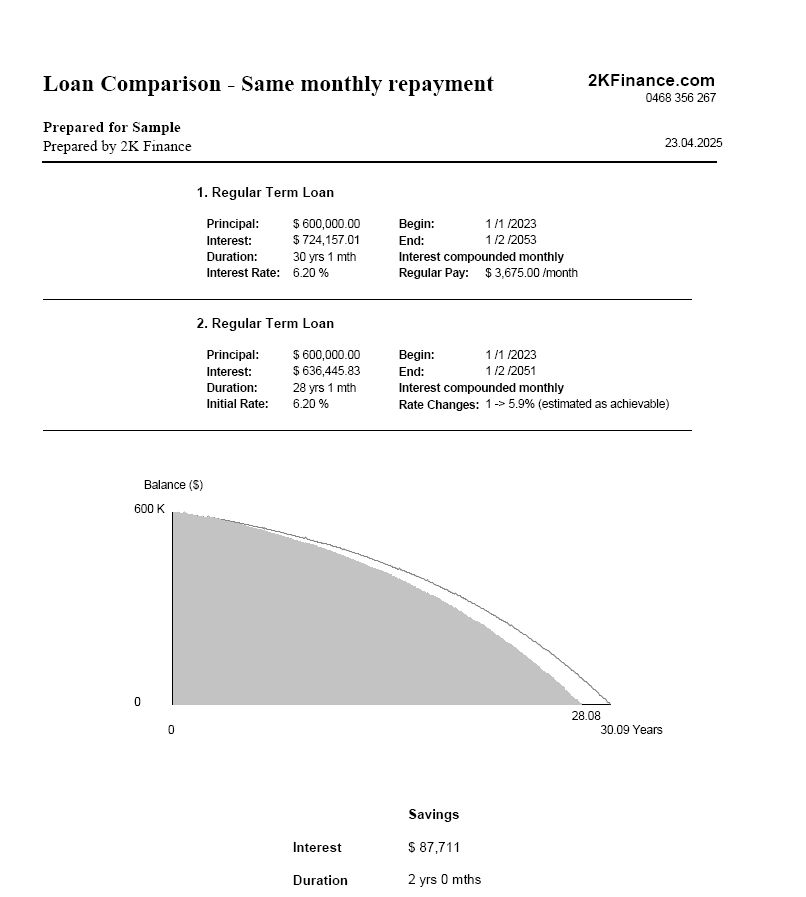

Our 1 Page Report is legendary with out partners. It provides a simple, easy to read analysis of what could be your savings with a simple debt restructuring process.

We understand that even though there are 101 things you can do to save money and time on your mortgage, reality is that if they are not solution you can easily implement into your lifestyle, then they are solutions that won’t work for you.

With our one page report, we look at the product you currently have and look at like-for-like options, assessing how much time and money you could save with the SAME REPAYMENTS & the same set-up.

Our 1-page report is an easy to digest report that visually shows you the time and money you could save with a simple restructure of your mortgage.

Get your 1-Page Report

Assumptions are made in making the 1-page report. Presented options cannot be confirmed until all information is collected. Eligibility criteria & terms & conditions apply. Subject to credit approval.

Pros. vs. Cons

Benefits

- Having all your debts in 1 easy to manage payment

- Lower overall interest rate & fees

- Potential for tax benefits

- Lower monthly repayments

- Can help increase borrowing capacity

Considerations

- Though your rate is less, a longer loan term may result in more interest paid

- Equity needs to be available if a mortgage is involved

- Can lead to more debt if spending habits don't change

- Lenders and government fees may apply

- Putting assets such as your home at risks if used as security

Copyright © 2026 2K Finance – Residential Mortgage Specialist | 2K Finance Credit Representative Number 549574 to Australian Credit Licence 377294. Information is general and non-specific to any individual. Always seek advice from a financial advisor.