Self Managed Super Fund

/Self Managed Super Fund (SMSF)

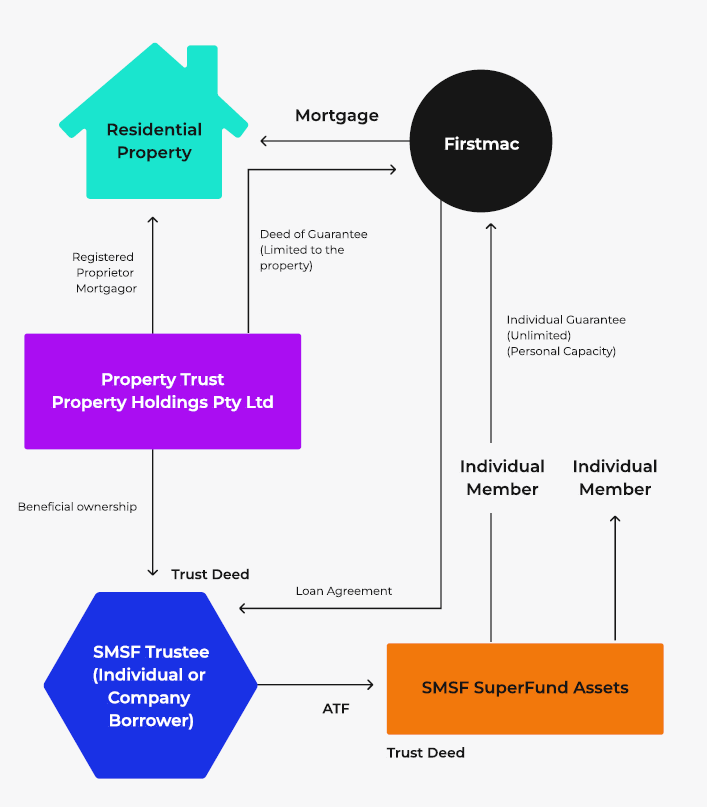

A Self-Managed Super Fund (SMSF) allows you to take greater control of your superannuation and, for many Australians, opens the door to property investment within their fund. Through an SMSF, you can purchase residential or commercial property using a limited recourse borrowing arrangement (LRBA), allowing your fund to leverage its balance while keeping other assets protected.

There are strict rules and compliance requirements when it comes to property investment through SMSFs — from ensuring the property meets the sole purpose test to navigating contribution caps and loan structures.

Our team works closely with your nominated accountant and/or financial adviser to ensure every aspect of your SMSF property strategy aligns with your long-term retirement goals and complies with ATO regulations.

SMSF Structure

Pros. vs. Cons

Benefits

- More control over your retirement strategy

- Wider range of investment opportunities such as gold, collectable items, etc,

- Set up a SMSF for up to 6 people

- Lenders can only repossess single assets related to a credit facility

- Great for doctors or consultants wanting to own their own premises

- Concessional tax rates

Considerations

- Establishment & ongoing costs

- Legal & regulatory requirements

- Unable to access equity from properties within SMSF

- Unable to construct within an SMSF

- Personally liable for the SMSF decisions

- Asset seperation issues if there is a fallout between members and you no longer want to continue

Copyright © 2026 2K Finance – Residential Mortgage Specialist | 2K Finance Credit Representative Number 549574 to Australian Credit Licence 377294. Information is general and non-specific to any individual. Always seek advice from a financial advisor.