First Home Buyer

/Personalized Guide

Get a personalized guide tailored to yourself, highlighting the grants, schemes & concessions you could be eligible for.

Grants, Schemes & Concessions Explained

There are many grants, schemes & concessions that are currently available to first home buyers purchasing their first home. Though they can definitely help, you don’t necessarily need to be restricted by the price limits and property requirements they require you to meet. Based on your specific circumstances, there could be alternate options available.

Below listed are some criteria to claim these benefits. There may be other criteria specific to the state purchased in & property type.

Stamp Duty Concession

An exemption or concession on the Stamp Duty payable

- 18 years old & individual or couple applicant

- Temporary Residents can claim the Stamp Duty Concession but may be subject to Foreign Ownership Surcharge & FIRB Approval

- Never claimed the first home vacant land concession

- Never held an interest in another residence anywhere in Australia or overseas

- Move into it with your personal belongings and live there on a daily basis within 1 year of settlement

- Purchase within property price caps & an acceptable dwelling

Home Guarantee Scheme

Avoid paying Lenders Mortgage Insurance (LMI) with a 2-5% deposit with the government acting as your guarantor

- Australia citizen or permanent resident (including NZ Citizen)

- 18 years old & individual or couple applicant

- Previous year NOA up to $125,000 for individual or $200,000 for couple (NOTE: You can be on a higher income for servicing)

- Owner occupiers of property

- First home buyers or previous homeowners who haven't owned or had an interest in a real property in Australia (this includes owning land only) in the past ten years.

- Purchase within property price caps

First Home Owner Grant

Access a cash grant for the purchase of a new home, renovated home or to build a home

- At least one applicant must be an Australian citizen or permanent resident

- 18 years old & individual or couple applicant

- Buying or building a new home or renovated home

- At least one applicant must occupy the home as your PPR for at least 6-12 months

- Have not received FHOG previously OR paid back if previously received

- Have not owned a home prior to 1st July 2000 OR not lived in a home owned after 1st July 2000 for over 6 months

- Purchase within property price caps

First Home Super Saver Scheme

The First Home Super Saver Scheme (FHSSS) lets you use your super to help buy your first home. By making voluntary contributions to your super fund, you can save faster thanks to a concession tax rate of 15% as opposed to typical tax rate up to 37%. Eligible first home buyers can withdraw up to $50,000 of these contributions (plus earnings) to put towards a deposit. It’s a smart way to boost your savings and get into the property market sooner.

There are rules around this, such as having a maximum contribution of $15,000 per financial year. Therefore to get the full $50,000 benefit it would take 3 financial years. Therefore if you are looking to use this scheme it is best to start early.

IMPORTANT: To use your FHSSS contributions you will need an ATO Determination Letter which you can get from the ATO Portal via myGov. This letter confirms how much funds are available to be used towards your purchase. You MUST have this letter prior to singing any contract of sale. You cannot use your FHSSS if you apply for your ATO Letter Of Determination after signing any contract of sale. This process can take up to 2 weeks typically.

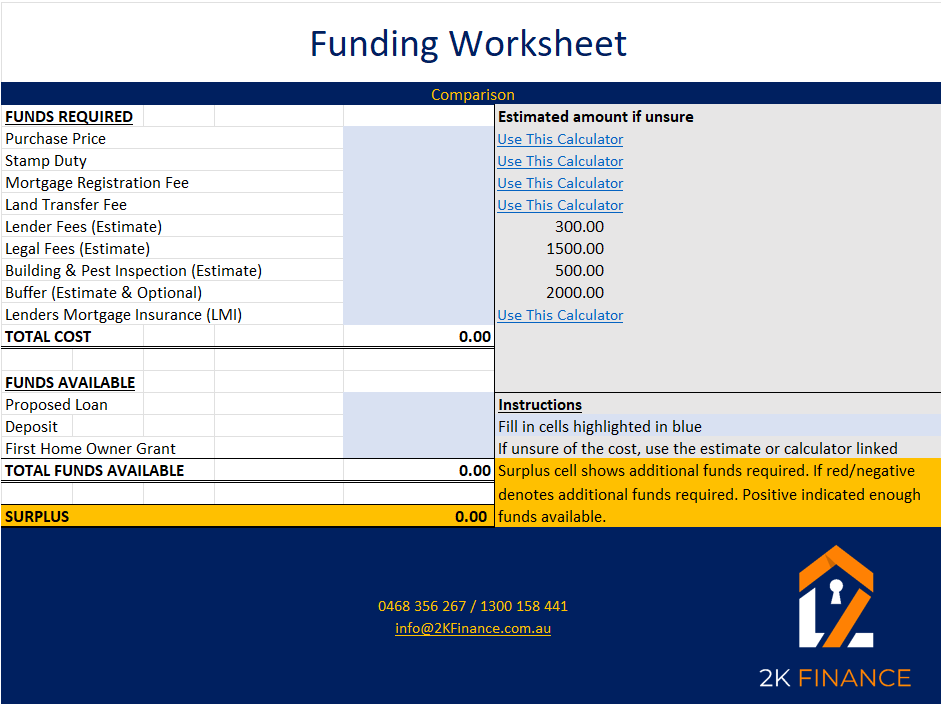

Costs

Purchasing a home has costs involved other than the deposit and stamp duty. Below are key fees and charges you should take into account.

- Costs & fees to consider

- Deposit

- Stamp Duty

- Mortgage Registration Fee

- Land Transfer Fee

- Lender Fee

- Legal/Conveyancing Fee

- Building & Pest Inspection

- Lenders Mortgage Insurance

- Buffer

Career Based LMI Waiver

The following careers typically can avoid paying LMI with a deposit less than 20%.

- Commercial Pilot

- Teachers

- Police Officer, Fire Fighters & Paramedics

- Doctors, Nurses & Allied Health Professionals (chiropractor, pharmacist, radiographer, physiotherapist, etc)

- Solicitors, Lawyers & Baristers

- Accountants, FInancial Analysts & Actuaries

Copyright © 2026 2K Finance – Residential Mortgage Specialist | 2K Finance Credit Representative Number 549574 to Australian Credit Licence 377294. Information is general and non-specific to any individual. Always seek advice from a financial advisor.